Justice Department Briefing 2025-07-25 Estimated reading time: 5 minutes 1. Agency Information Collection Activities; Proposed eCollection eComments Requested; Revision of a Currently Approved Collection; Requirement That Movie Theaters Provide Notice as to the Availability of Closed Movie Captioning and Audio Description for Digital Movies Sub: Justice Department Content: The Civil Rights Division, Disability Rights Section (DRS) Department of Justice will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. 2. Taha Dias, M.D.; Decision and Order Sub: Justice Department, Drug Enforcement Administration 3. Notice Pursuant to the National Cooperative Research and Production Act of 1993-America’s Datahub Consortium Sub: Justice Department, Antitrust Division 4. Notice Pursuant to the National Cooperative Research and Production Act of 1993-Decentralized Storage Alliance Association Sub: Justice Department, Antitrust Division 5. Notice Pursuant to the National Cooperative Research and Production Act of 1993-1EdTech Consortium, Inc. Sub: Justice Department, Antitrust Division 6. Notice Pursuant to the National Cooperative Research and Production Act of 1993-Bytecode Alliance Foundation Sub: Justice Department, Antitrust Division 7. Agency Information Collection Activities; Proposed eCollection eComments Requested; New collection; Title-User Access Request Form for EPIC System Portal (ESP) Sub: Justice Department Content: The Drug Enforcement Administration, Department of Justice (DOJ), will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. 8. Schedules of Controlled Substances: Extension of Temporary Placement of Clonazolam, Diclazepam, Etizolam, Flualprazolam, and Flubromazolam in Schedule I of the Controlled Substances Act Sub: Justice Department, Drug Enforcement Administration Content: The Acting Administrator of the Drug Enforcement Administration (DEA) is issuing this temporary scheduling order to extend the temporary schedule I status of five designer benzodiazepines–clonazolam, diclazepam, etizolam, flualprazolam, and flubromazolam. In an order dated July 26, 2023, DEA temporarily placed these five substances in schedule I of the Controlled Substances Act. This temporary order will extend the temporary scheduling of five designer benzodiazepines for one year, or until the permanent scheduling action for these substances is completed, whichever occurs first. As a result of this order, the regulatory controls and administrative, civil, and criminal sanctions applicable to schedule I controlled substances will continue to be imposed on persons who handle (manufacture, distribute, reverse distribute, import, export, engage in research, conduct instructional activities or chemical analysis with, or possess) or propose to handle these five specified controlled substances. 9. Schedules of Controlled Substances: Placement of Clonazolam, Diclazepam, Etizolam, Flualprazolam, and Flubromazolam in Schedule I of the Controlled Substances Act Sub: Justice Department, Drug Enforcement Administration Content: The Drug Enforcement Administration proposes placing clonazolam, diclazepam, etizolam, flualprazolam, and flubromazolam and their salts, isomers, and salts of isomers, whenever the existence of such salts, isomers, and salts of isomers is possible within the specific chemical designation, as identified in this proposed rule, in schedule I of the Controlled Substances Act. These five substances were temporarily scheduled in an order dated July 26, 2023, and subsequently extended until July 26, 2026, pursuant to an extension published elsewhere in this issue of the Federal Register. This action will also enable the United States to meet its obligations under the 1971 Convention on Psychotropic Substances. If finalized, this action would make permanent the existing regulatory controls and administrative, civil, and criminal sanctions applicable to schedule I controlled substances on persons who handle (manufacture, distribute, import, export, engage in research, conduct instructional activities or chemical analysis, or possess), or propose to handle these five specific controlled substances. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Initiation of Antidumping and Countervailing Duty Administrative Reviews

U.S. Department of Commerce Begins Reviews on Antidumping and Countervailing Duties for Multiple Countries Estimated reading time: 5–10 minutes On July 25, 2025, the U.S. Department of Commerce (Commerce) announced the start of new administrative reviews for antidumping duty (AD) and countervailing duty (CVD) orders. These reviews address orders with June anniversary dates. Commerce follows the rules in 19 CFR 351.213(b) to begin these reviews. Details of the Reviews Commerce reviews if products from other countries are sold in the U.S. at unfair prices, or if foreign governments give unfair help to exporters. These reviews help decide if special taxes should stay on imported goods. Respondent Selection Process Commerce may choose specific companies (respondents) to check more closely. It uses data from U.S. Customs or direct questions about sales. The selection process usually happens within 35 days after this notice is published. If a company already was found to be part of a group with others for past reviews, Commerce will treat them together again. Companies need to clearly state if they were grouped with others before. No Sales and Withdrawal Rules If a company did not sell the product during the review period, it can notify Commerce within 30 days. Companies that asked for a review can withdraw that request within 90 days, unless Commerce extends the deadline. Particular Market Situation Allegations Companies or interested parties can claim there was a special market situation (PMS) that affected costs. These claims and all support must be sent within 20 days after section D questionnaire responses. Separate Rates in Non-Market Economy (NME) Countries Companies in NME countries must prove they act independently from their government to get a separate AD rate. Certification or a new application is due within 14 calendar days after this notice is published. The forms are on Commerce’s website. Certification Eligibility Some companies export both covered and non-covered goods. They must submit a Certification Eligibility Application within 30 calendar days if they want to participate in the certification program. The application is on the Commerce website. Products and Countries Reviewed Some of the main products and countries covered in these reviews are: Raw honey from Argentina, Brazil, India, and Vietnam Brass rod from Brazil, India, Mexico, Republic of Korea, and South Africa Glycine from India and Japan Quartz surface products from India and Turkiye Cold-drawn mechanical tubing from Germany, India, Italy, and Switzerland Chlorinated isocyanurates from Spain and China Prestressed concrete steel wire strand from Malaysia, Spain, Turkiye, and Ukraine Non-refillable steel cylinders from India Boltless steel shelving units from Taiwan, Thailand, and Vietnam Commerce lists specific companies in each country for review. The review period dates can vary by product and country. Duty Absorption Commerce may check if exporters have absorbed dumping duties. Domestic parties must request this check within 30 days. Gap Period Liquidation For a first review, there will be no AD or CVD charges on goods brought into the country during any “gap” period between temporary and final measures, if applicable. Administrative Procedures Interested parties must apply for access to business information as per Commerce’s rules. Factual information must follow the correct category and submission standards in 19 CFR 351.102(b)(21) and 19 CFR 351.301. All information must be certified for accuracy. Extension of Time Limits Applications for more time must be made before deadlines. For joint submissions, extension requests are untimely if filed after 10 a.m. on the due date. Official Contact For questions, contact Brenda E. Brown, AD/CVD Operations, Customs Liaison Unit, Enforcement and Compliance, International Trade Administration (phone: 202-482-4735). Regulatory References These processes are under section 751(a) of the Tariff Act of 1930 (19 U.S.C. 1675(a)) and 19 CFR 351.221(c)(1)(i). This notice was signed by Scot Fullerton, Acting Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations, U.S. Department of Commerce, on July 22, 2025. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Notice of Scope Ruling Applications Filed in Antidumping and Countervailing Duty Proceedings

Commerce Department Announces June 2025 Scope Ruling Applications in Antidumping and Countervailing Duty Cases Estimated reading time: 5–10 minutes On July 25, 2025, the U.S. Department of Commerce, International Trade Administration, published a list of scope ruling applications received in June 2025 for antidumping (AD) and countervailing duty (CVD) proceedings. These applications ask the Department to decide if certain products fall under the scope of AD or CVD orders. List of Scope Ruling Applications The following applications were submitted: 1. Aluminum Lithographic Printing Plates from Japan (A-588-881) Product: Flexographic printing plates. Description: Contains 40-80% styrene polymer coating, 20-40% butadiene coating, 5-20% polymer resins and colorants, and 5-10% polyester substrate. These plates do not contain aluminum. They are flexible, made for flexographic printing presses, and are not used with lithographic presses. Produced and exported from: Japan. Applicant: Miraclon Corporation Ltd. Date filed: June 4, 2025. ACCESS scope segment: “Non-Aluminum-Based Printing Plates”. 2. Certain Walk-Behind Lawn Mowers and Parts Thereof from China (A-570-129/C-570-130) Product: Walk-behind lawn mowers. Description: Rotary lawn mowers, both self-propelled and push type. Powered by internal combustion engines under 3.7 kw, maximum displacement of 197cc. Assembled in Thailand with U.S.-origin engines and Chinese chassis. The cutting deck shell and blade parts are attached in Thailand. Produced in and exported from: China. Applicant: Daye North America, Inc. (DNA). Date filed: June 6, 2025. ACCESS scope segment: “DNA US Engines”. 3. Stainless-Steel Flanges from India (A-533-877/C-533-878) Product: Ring-shaped components of measurement instruments. Description: Made of various metals, these rings reinforce measurement instrument parts and connect the instrument to a flange. The products may have any of the following features: non-standard bore, hub, precision or stepped grooves, threads, chamfering, bolt holes, tapped holes, or non-standard neck length. Produced and exported from: India. Applicant: Pradeep Metals Limited, Inc. Date filed: June 25, 2025. ACCESS scope segment: “Ring-shaped Components”. Process and Deadlines This list shows applications filed but does not mean scope inquiries have started. The Department will accept applications or start inquiries within 30 days of filing. If the 30th day is not a business day, action will occur on the next business day. If there are both AD and CVD orders for the same product from the same country, the inquiry will be on the AD proceeding record. The Department may apply a scope ruling country-wide or to specific companies. Other interested parties must file an entry of appearance to participate. For more details on procedures, refer to the Scope Ruling Application Guide at https://access.trade.gov/help/Scope_Ruling_Guidance.pdf. Notices of scope ruling applications may be posted before or after a scope inquiry begins. To check the latest information, visit the ACCESS system at https://access.trade.gov. Parties can request to be on the service list for a specific order each year during the order’s anniversary month. Comments and Contact Information Comments on the completeness of this list can be sent to Scot Fullerton, Acting Deputy Assistant Secretary for AD/CVD Operations, International Trade Administration, at [email protected]. This notice is issued under 19 CFR 351.225(d)(3). Dated: July 22, 2025. Scot Fullerton, Acting Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

ITA Briefing 2025-07-25

Commerce Department, International Trade Administration Briefing 2025-07-25 Estimated reading time: 3 minutes 1. Notice of Scope Ruling Applications Filed in Antidumping and Countervailing Duty Proceedings Sub: Commerce Department, International Trade Administration Content: The U.S. Department of Commerce (Commerce) received scope ruling applications, requesting that scope inquiries be conducted to determine whether identified products are covered by the scope of antidumping duty (AD) and/or countervailing duty (CVD) orders and that Commerce issue scope rulings pursuant to those inquiries. In accordance with Commerce’s regulations, we are notifying the public of the filing of the scope ruling applications listed below in the month of June 2025. 2. Initiation of Antidumping and Countervailing Duty Administrative Reviews Sub: Commerce Department, International Trade Administration Content: The U.S. Department of Commerce (Commerce) has received requests to conduct administrative reviews of various antidumping duty (AD) and countervailing duty (CVD) orders with June anniversary dates. In accordance with Commerce’s regulations, we are initiating those administrative reviews. 3. Steel Concrete Reinforcing Bar From Algeria, Egypt, and the Socialist Republic of Vietnam: Postponement of Preliminary Determinations in the Countervailing Duty Investigations Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Agency Information Collection Activities; Proposed eCollection eComments Requested; Revision of a Currently Approved Collection: National Crime Victimization Survey (NCVS)

Department of Justice Seeks Public Comments on National Crime Victimization Survey Changes Estimated reading time: 4–6 minutes On July 24, 2025, the Department of Justice (DOJ), Bureau of Justice Statistics (BJS), published a notice in the Federal Register about the National Crime Victimization Survey (NCVS). The BJS is asking the public for comments on a planned update for the NCVS. The updates must be approved by the Office of Management and Budget (OMB). The public can send comments for 60 days, ending on September 22, 2025. The NCVS collects national information about how often people in the United States experience crime. The survey counts crimes both reported and not reported to the police. The NCVS also collects data on how police handle reports and how safe people feel in their communities. Every so often, the survey process is updated. The 2026 update uses new methods to better represent the U.S. population using 2020 census data. Details of the Collection: Type: This is a revision of a currently approved collection. Title: National Crime Victimization Survey. Form Numbers: NCVS-1 and NCVS-2. Agency: Bureau of Justice Statistics, Office of Justice Programs. Who Responds: U.S. residents age 12 or older living in selected households. Responding is voluntary. Estimates for the Survey: Total Respondents per Year: 157,439 people. Time to Complete Survey (Average Interview): 34.4 minutes. Time for Non-Interviewed Respondents: 9.3 minutes. Follow-up Interview Time: 7 minutes. Follow-up for Non-interview: 1 minute. Annual Burden (Total Hours): 123,202 hours. Annual Cost Burden: $0. Burden Hours by Activity: Activity Respondents Frequency Annual Responses Time per Response (minutes) Annual Burden (hours) Interviewed 91,312 2 182,624 34.4 104,698 Non-interviewed 56,772 2 113,544 9.3 17,599 Re-interview (Interviews) 7,484 1 7,484 7.0 873 Re-interview (Non-interviews) 1,871 1 1,871 1.0 31 Unduplicated Totals 157,439 — 305,523 — 123,202 How to Comment or Get More Information: Those with suggestions or questions can contact Rachel Morgan, Chief of the Victimization Statistics Unit at the BJS. Her office is located at 999 N Capitol Street NE, Washington, DC 20531. Email and phone contacts are also provided: [email protected], 202-307-0765. For further information, Darwin Arceo, Department Clearance Officer at the DOJ, is also listed as a contact. Key Points for Comments: The DOJ asks the public to focus on these points in their comments: Is the survey needed for the BJS to do its job well? Are the time estimates and methods correct? Can the collected information be improved? Can the burden on respondents be reduced by using technology? The deadline for public comments is September 22, 2025. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Agency Information Collection Activities; Proposed eCollection eComments Requested; New Collection; Semi-Annual and Annual Performance Reporting Data Catalog for Formula and Discretionary Grant Programs

Department of Justice Proposes New Data Collection for Violence Against Women Act Grants Estimated reading time: 4–6 minutes The Office on Violence Against Women (OVW), part of the Department of Justice, has announced a new proposal for collecting information from grantees of programs under the Violence Against Women Act (VAWA). These changes are explained in a notice published in the Federal Register on July 24, 2025. What is the New Plan? The OVW wants to combine 19 current performance reporting forms into one new, streamlined system. This system will collect data from groups that receive money under VAWA. It will cover both “formula” programs, such as STOP and SASP, and “discretionary” programs. This means all grantees and subgrantees will use the same online reporting platform. Who Will Use This System? The new system will be used by: Formula grant program administrators Formula grant subgrantees Discretionary grant program grantees These groups include local, state, and tribal governments, courts, non-profits, schools, colleges, coalitions, and other groups. How Does It Work? The new system uses a web-based form. The form is tailored for each grant program. Grantees will only complete sections about activities funded by their grant. Why Change the Old System? Currently, 19 different forms are in use, collecting similar or repetitive data in different ways. The new plan will: Make reporting easier and faster Use clearer questions Cut out repeated questions Allow electronic submission This is expected to improve the quality, usability, and consistency of the data. It will also make future updates easier if VAWA or government needs change. How Much Work Will This Involve? The estimate for reporting is: About 6,112 groups will need to report Each form takes about 60 minutes to complete The workload for each group is: Formula administrators: 112 responses per year (once a year per respondent) Formula subgrantees: 3,000 responses per year (once per respondent) Discretionary grantees: 6,000 responses per year (twice per respondent) The total amount of reporting time is estimated at 9,112 hours per year. How Much Does It Cost? The OVW estimates the total annual cost to review the reports and keep the system running is $800,000. What Happens Next? This is a proposed plan. The OVW wants public feedback. Comments will be accepted until September 22, 2025. If you have questions or want to comment, contact Tiffany Watson at the Office on Violence Against Women at 202-307-6026, or email OVW for a copy of the collection instrument or more information. Conclusion The Department of Justice is working to make it easier and faster for groups to report on activities funded by Violence Against Women Act grants. The new system is designed to cut paperwork and improve the way data is collected and used. Groups affected by these changes can learn more and share their feedback before September 22. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Agency Information Collection Activities; Proposed eCollection eComments Requested; Extension, With Changes, of a Currently Approved: Title-National Prisoner Statistics program (NPS)

Department of Justice Proposes Changes to National Prisoner Statistics Program Estimated reading time: 4–6 minutes The Bureau of Justice Statistics (BJS), a part of the U.S. Department of Justice, is planning to update the National Prisoner Statistics program (NPS). The BJS has asked the public for comments on this plan. Comments will be accepted for 60 days, ending on September 22, 2025. Information Collected The NPS program collects yearly numbers about prisoners held by state and federal prisons. It tracks the number of people admitted and released. The information is used to report on how people move through the prison system each year. This helps the BJS show changes in the prison population and supports the work of many people. Key Changes One change is that questions about HIV/AIDS will be removed. These may come back in special health supplements in the future. The BJS also plans to test a new way to collect race and ethnicity data. This matches the rules in the 2024 OMB Statistical Policy Directive No. 15. The BJS will also check if more race and ethnicity data can be collected from the current data systems. Who Must Report NPS-1B: Used by 51 reporters (one from each state and the Federal Bureau of Prisons). NPS-1B(T): Used by five reporters from U.S. Territories or Commonwealths (Guam, Puerto Rico, Northern Mariana Islands, Virgin Islands, American Samoa). Information Required from States and Federal Prisons Each year, the 51 reporters must give details including: The number of men and women in prison as of December 31, sorted by sentence length and if they are unsentenced. How many people are housed in private, county, or other facilities. Admission types: new court commitments, parole violators, other transfers, and returns. Release types: finished sentences, commutations, probation, parole, deaths by cause, transfers, and other categories. Prisoners by race and Hispanic origin. U.S. citizenship status of prisoners. The source used for citizenship data. The capacities of prisons, broken down by sex. Information Required from Territories and Commonwealths Each year, the five reporters from the territories must provide: Number of men and women in prison as of December 31 by sentence length, and how complete those numbers are. People sent to other places to reduce overcrowding. Prisoners by race and Hispanic origin. The end-of-year capacities of correctional facilities by sex. Why This Matters The Bureau of Justice Statistics uses the collected information for government reports. These reports are used by Congress, the President, researchers, students, media, and others interested in crime and justice data. Response Details Responding to the survey is voluntary. Each of the 51 main respondents will spend about 4.5 hours each year on the NPS-1B form. The five territory respondents will each spend about 2 hours on the NPS-1B(T) form. The total estimated burden is 795 hours over three years, or about 265 hours per year. The overall cost for all respondents is estimated at $577,000 per year. Contact Information For questions or copies of the data collection forms, contact Derek Mueller, Bureau of Justice Statistics, at 999 N Capitol St. NE, Washington, DC 20531, or call 202-307-0765. If you need more information, you can also contact Darwin Arceo at the Department of Justice, 145 N Street NE, Washington, DC 20530. Publication Information This notice was published in the Federal Register, Volume 90, Number 140, on July 24, 2025. The notice number is 2025-13933. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Agency Information Collection Activities; Proposed eCollection eComments Requested; Revision of a Previously Approved Collection; Title-Federal Firearms Licensee (FFL) Enrollment/National Instant Criminal Background Check System (NICS) E-Check Enrollment Form, Federal Firearms Licensee (FFL) Officer/Employee Acknowledgment of Responsibilities Under the NICS Form, Responsibilities of a Federal Firearms Licensee (FFL) Under the National Instant Criminal Background Check System (NICS) Form

DOJ Announces Proposed Changes to Federal Firearms Licensee NICS Forms Estimated reading time: 2-3 minutes The Department of Justice (DOJ), through the Federal Bureau of Investigation (FBI), has announced a proposed revision to the information collection for Federal Firearms Licensees (FFLs). This proposal was published in the Federal Register on July 24, 2025. The revision concerns important forms related to the National Instant Criminal Background Check System (NICS). These forms include the FFL Enrollment/NICS E-Check Enrollment Form, the FFL Officer/Employee Acknowledgment of Responsibilities under the NICS Form, and the Responsibilities of an FFL under the NICS Form. The FBI is inviting public comments on the proposed changes. The comment period is open for 60 days, ending September 22, 2025. The changes include adding four new fields to the form. The new questions ask for the FFL’s date of birth and the mother’s maiden name for security reasons. There is also a new question for FFLs in Point of Contact (POC) states. If the FFL operates in a POC state, they must confirm they will use the FBI NICS system for authorized purposes only. The main purpose of collecting this information is to control access to the NICS and NICS Electronic (E-Check) systems. The forms help protect the privacy and security of background check information. They ensure only authorized users, like FFLs and employees in POC states, can use the NICS system. The DOJ estimates that 6,160 respondents will complete these forms each year. Completing and reading the forms takes about 15 minutes per person. This results in a total estimated burden of 1,540 hours yearly. The cost for respondents is $0, as the forms are available online and can be signed digitally. No mailing or copying costs are required. The responses are required for FFLs or POC states to obtain access to the NICS system to perform background checks for firearm sales. Anyone needing more information or wishing to review the proposed information collection can contact Jill Montgomery at the FBI NICS Section in Clarksburg, West Virginia. For official details or to send in comments, the announcement provides contact information for Darwin Arceo, the Department Clearance Officer at the Department of Justice. More information on the NICS is available at https://www.fbi.gov/services/cjis/nics. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Agency Information Collection Activities; Proposed eCollection eComments Requested; Revision of a Currently Approved Collection; Comments Requested: Title-Special Deputation Forms

U.S. Marshals Service Requests Comments on Special Deputation Forms Estimated reading time: 3–5 minutes The U.S. Marshals Service (USMS) is seeking public comments on its Special Deputation Forms. This request was announced by the Department of Justice in the Federal Register, Volume 90, Number 140, on July 24, 2025. The USMS wants to collect feedback as part of a review required by the Paperwork Reduction Act of 1995. Comments are being accepted for 60 days, ending on September 22, 2025. Collection Details The USMS is revising its current approval for forms used in the Special Deputation Program. These forms help record and track people deputized to act as Special Deputy U.S. Marshals. Special Deputation is permitted when law enforcement needs arise, as decided by the Associate Attorney General under 28 CFR 0.19(a)(3). There are two main forms: USM-3A: Application for Special Deputation/Sponsoring Federal Agency Information. USM-3C: Group Special Deputation Request. These forms are completed by State, Local, and Tribal Governments. Estimated Usage and Burden USM-3A: It is estimated that 8,000 respondents will use this form every year. Each form will take about 10 minutes to complete. This adds up to around 1,333 total annual burden hours. USM-3C: Around 300 respondents are expected to use this form annually, with each taking about 15 minutes. This totals 75 annual burden hours. The annual cost burden for both forms is estimated at $0.00. Table of Annual Burden Activity Number of Respondents Frequency (Annually) Total Annual Responses Time per Response (Mins) Total Annual Burden (Hours) USM-3A Application for Special Deputation 8,000 1 8,000 10 1,333 USM-3C Group Special Deputation Request 300 1 300 15 75 Total 8,300 1,408 Instructions for Comments The USMS is asking for comments about the following points: Is the information necessary for the agency’s work? Is the estimated burden and response time correct? Can the quality and clarity be improved? How can the burden on respondents be reduced, for example, by using electronic submissions? People needing more information or wishing to submit comments can contact Assistant Chief Karl Slazer, Management Support Division, US Marshals Service Headquarters, 1215 S Clark St., Ste. 10017, Arlington, VA 22202-4387. Phone: 703-740-2316, or email: [email protected]. If further information is needed, contact Darwin Arceo, Department Clearance Officer, Justice Management Division, U.S. Department of Justice. The notice is signed by Darwin Arceo, Department Clearance Officer for PRA, dated July 22, 2025. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

DOJ Briefing 2025-07-24

Justice Department Briefing 2025-07-24 Estimated reading time: 5 minutes 1. Agency Information Collection Activities; Proposed eCollection eComments Requested; Revision of a Currently Approved Collection; Comments Requested: Title-Special Deputation Forms Sub: Justice Department Content: The U.S. Marshals Service (USMS), Department of Justice (DOJ), will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. 2. Agency Information Collection Activities; Proposed eCollection eComments Requested; Revision of a Previously Approved Collection; Title-Federal Firearms Licensee (FFL) Enrollment/National Instant Criminal Background Check System (NICS) E-Check Enrollment Form, Federal Firearms Licensee (FFL) Officer/Employee Acknowledgment of Responsibilities Under the NICS Form, Responsibilities of a Federal Firearms Licensee (FFL) Under the National Instant Criminal Background Check System (NICS) Form Sub: Justice Department Content: The Department of Justice (DOJ), Federal Bureau of Investigation (FBI), Criminal Justice Information Services (CJIS) Division, will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. 3. Agency Information Collection Activities; Proposed eCollection eComments Requested; Extension, With Changes, of a Currently Approved: Title-National Prisoner Statistics program (NPS) Sub: Justice Department Content: The Bureau of Justice Statistics (BJS), Department of Justice (DOJ) will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. 4. Agency Information Collection Activities; Proposed eCollection eComments Requested; New Collection; Semi-Annual and Annual Performance Reporting Data Catalog for Formula and Discretionary Grant Programs Sub: Justice Department Content: The Office on Violence Against Women, Department of Justice, will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. 5. Agency Information Collection Activities; Proposed eCollection eComments Requested; Revision of a Currently Approved Collection: National Crime Victimization Survey (NCVS) Sub: Justice Department Content: The Bureau of Justice Statistics (BJS), Department of Justice (DOJ) will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled Into Modules, From the People’s Republic of China: Final Results of Changed Circumstances Reviews, and Revocation of the Antidumping and Countervailing Duty Orders, in Part

U.S. Department of Commerce Issues Final Results of Changed Circumstances Reviews on Certain Solar Cells From China Estimated reading time: 5–10 minutes Background The original duty orders were put in place on December 7, 2012. On August 28, 2024, Lutron Electronics Co., Inc. asked the Department of Commerce to review the orders. Lutron asked to remove certain small, low-wattage, off-grid CSPV cells from the orders. The Commerce Department started the review on October 21, 2024. They asked for comments from other companies and interested groups, but did not receive any comments. On April 23, 2025, Commerce said they believed most U.S. producers were no longer interested in keeping the orders for these specific products. Commerce planned to end, in part, the orders for certain CSPV cells. Commerce again allowed for comments or requests for a public hearing. No comments or requests were received. Final Results and Revocation The Department of Commerce found that there is no interest from U.S. producers to keep the orders for the products under review. No parties opposed this change. Because of this, Commerce ended the duty orders for CSPV cells with these exact features: Off-grid CSPV panels in rigid form, with or without a glass cover. Permanently attached to an aluminum extrusion that is part of an automation device controlling natural light. Total power output of 20 watts or less per panel. Maximum surface area of 1,000 cm² per panel. No built-in inverter for powering third-party devices. Scope of Orders and Other Exclusions The orders cover crystalline silicon photovoltaic cells and panels. Many exclusions apply. These include products like thin film photovoltaic products and panels with very specific outputs, sizes, or applications. The order details other exclusions, such as: Panels not exceeding 10,000 mm² and permanently built into a consumer good. Specific panels with surface area, voltage, ampere, and watt constraints. Off-grid panels in rigid form of 100 watts or less per panel and certain design features. CSPV panels in rigid form with a glass cover, used for converting water vapor into water, with detailed size and feature requirements. Small portable off-grid panels with outputs of 200 watts or less and carrying features like a handle and integrated kickstands. Exclusions are detailed by product size, power output, design, and intended use. Retroactive Application Commerce will apply the change retroactively. For the AD order, it covers goods entered or withdrawn from warehouse for use on or after December 1, 2022. For the CVD order, it starts on January 1, 2022. Unliquidated entries fitting the exclusion will be liquidated without AD or CVD duties. Deposits for such duties will be refunded on these entries. Instructions will go to U.S. Customs and Border Protection, usually 35 days or more after the date of the notice. If a legal challenge is filed, liquidation of entries will be paused until the court process, with specific timelines for filing an injunction. Administrative Details This notice serves as a final reminder to companies under an administrative protective order (APO) to return or destroy APO materials as required by law. The Department of Commerce issued and published this result under sections 751(b) and 777(i) of the Tariff Act and related regulations. Date The action is effective July 24, 2025. Contact Information For questions, contact Tyler O’Daniel, Office of Policy, Enforcement and Compliance, International Trade Administration, U.S. Department of Commerce, Washington, DC, telephone: (202) 482-6030. Signed Christopher Abbott, Deputy Assistant Secretary for Policy and Negotiations, Department of Commerce. Federal Register Document No. 2025-13953, published July 24, 2025. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Crystalline Silicon Photovoltaic Products, Whether or Not Assembled Into Modules, From the People’s Republic of China: Final Results of Changed Circumstances Reviews, and Revocation of the Antidumping and Countervailing Duty Orders, in Part

U.S. to Drop Duties on Some Small Solar Products from China Estimated reading time: 3–5 minutes The U.S. Department of Commerce has announced a new decision on special tariffs for certain solar products from China. The announcement appears in the Federal Register, Volume 90, Issue 140, dated July 24, 2025. Background In 2015, the United States began charging extra taxes called antidumping (AD) and countervailing duties (CVD) on crystalline silicon photovoltaic (CSPV) products from China. These products are often used to make solar panels. On August 28, 2024, the company Lutron, which makes and sells solar products, asked the Department of Commerce to review these duties for a special kind of product: small, low-wattage, off-grid CSPV cells. These products are used in devices that control natural light. The request asked for the duties to no longer apply to these specific products. The American Alliance for Solar Manufacturing, a group representing U.S. solar producers, said it did not oppose the request. Commerce looked for more comments, but none were received from other parties. Final Results The Department of Commerce found that U.S. producers who make this type of CSPV cell do not want the extra tariffs for these products. Because of this, the government will remove the duties on these certain small, low-wattage, off-grid CSPV solar cells from China. Details of the Excluded Products The following products are now excluded from the tariffs: Off-grid CSPV panels in rigid form, with or without a glass cover. They must be permanently attached to an aluminum frame that is part of an automation device for controlling natural light. They can be assembled into a fully completed light control device or not. The panels must meet all these conditions: The panel’s total power output is 20 watts or less. The panel’s surface area is no more than 1,000 square centimeters. The panel does not have a built-in inverter to power third-party devices. Scope of Solar Products Still Affected The anti-dumping and countervailing duties will still apply to other types of crystalline silicon photovoltaic modules, panels, and laminates made or assembled in China, except for those products with specific exemptions. Some products, including thin film photovoltaic products and certain small integrated solar panels in consumer goods, were already excluded from the duties. The new exclusion adds the small, low-wattage, off-grid CSPV panels described above. Action for Importers The Department of Commerce will tell U.S. Customs and Border Protection (CBP) to remove the tariffs from all small, low-wattage, off-grid CSPV panels that were entered into the U.S. (or taken from a warehouse for use) starting from December 1, 2022, for AD duties and January 1, 2022, for CVD duties. Importers may get refunds of duties they already paid on these items. If there is a legal challenge, the CBP will pause liquidation until legal timelines end. Other Information The reminder also covers how companies under special protective orders should handle private information after the decision. This change is now final as of July 24, 2025. Contact Questions can be sent to Tyler O’Daniel, Office of Policy Enforcement and Compliance, International Trade Administration. Phone: (202) 482-6030. The full notice is available in the Federal Register at www.gpo.gov. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

ITA Briefing 2025-07-24

Commerce Department, International Trade Administration Briefing 2025-07-24 Estimated reading time: 6 minutes 1. Heavy Walled Rectangular Welded Carbon Steel Pipes and Tubes From Mexico: Final Results of Antidumping Duty Administrative Review; 2022-2023 Sub: Commerce Department, International Trade Administration Content: The U.S. Department of Commerce (Commerce) determines that producers/exporters of heavy-walled rectangular welded carbon steel pipes and tubes (HWR) from Mexico made sales of subject merchandise at less than normal value during the period of review (POR), September 1, 2022, through August 31, 2023. 2. Certain Crystalline Silicon Photovoltaic Products, Whether or Not Assembled into Modules, From Taiwan: Final Results of Changed Circumstances Reviews, and Revocation of the Antidumping and Countervailing Duty Orders, in Part Sub: Commerce Department, International Trade Administration Content: The U.S. Department of Commerce (Commerce) is issuing the final results of changed circumstances review (CCR) of the antidumping duty (AD) order on crystalline silicon photovoltaic products, whether or not assembled into modules (solar products), from Taiwan to revoke the order, in part, with respect to certain crystalline silicon photovoltaic (CSPV) cells. 3. Crystalline Silicon Photovoltaic Products, Whether or Not Assembled Into Modules, From the People’s Republic of China: Final Results of Changed Circumstances Reviews, and Revocation of the Antidumping and Countervailing Duty Orders, in Part Sub: Commerce Department, International Trade Administration Content: The U.S. Department of Commerce (Commerce) is issuing the final results of changed circumstances review (CCR) of the antidumping duty (AD) and countervailing duty (CVD) orders on crystalline silicon photovoltaic products, whether or not assembled into modules (solar products), from the People’s Republic of China (China) to revoke the order, in part, with respect to certain small, low-wattage, off-grid crystalline silicon photovoltaic (CSPV) cells. 4. Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled Into Modules, From the People’s Republic of China: Final Results of Changed Circumstances Reviews, and Revocation of the Antidumping and Countervailing Duty Orders, in Part Sub: Commerce Department, International Trade Administration Content: The U.S. Department of Commerce (Commerce) is issuing the final results of changed circumstances reviews (CCRs) of the antidumping duty (AD) and countervailing duty (CVD) orders on crystalline silicon photovoltaic cells, whether or not assembled into modules (solar cells), from the People’s Republic of China (China) to revoke the orders, in part, with respect to certain crystalline silicon photovoltaic (CSPV) cells. 5. Float Glass Products From Malaysia: Preliminary Negative Critical Circumstances Determination in the Countervailing Duty Investigation Sub: Commerce Department, International Trade Administration Content: The U.S. Department of Commerce (Commerce) preliminarily determines that critical circumstances do not exist with respect to imports of float glass products in the countervailing duty (CVD) investigation of float glass products from Malaysia. The period of investigation is January 1, 2023, through December 31, 2023. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

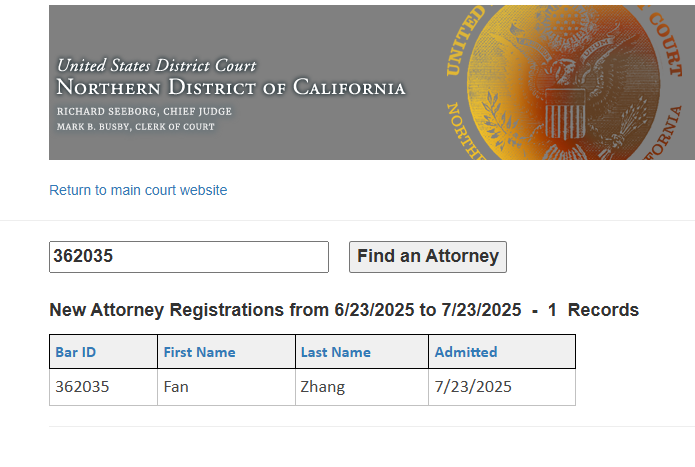

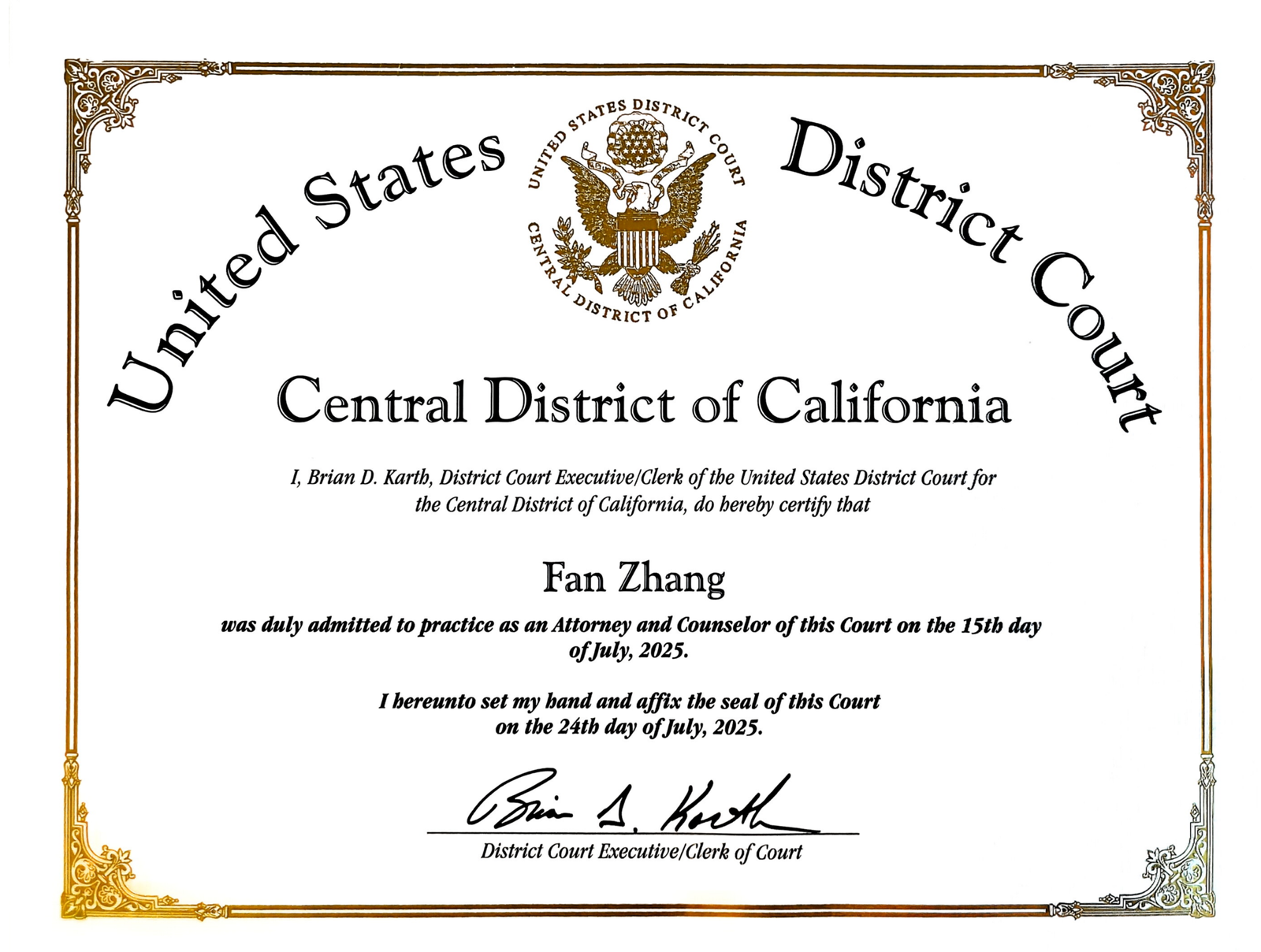

NDCA Attorney for U.S. Federal Litigation

At the Tianfu Central Legal Zone Forum, Fan Zhang, Director at JINGSH Chengdu, accepts the award designating JINGSH Riyadh Office as an official Overseas Legal Service Station, strengthening global legal support for Chinese enterprises.

Publication of Venezuela Sanctions Regulations Web General Licenses 41A, 5R, and 41B

Treasury Issues New Licenses for Venezuela Sanctions Estimated reading time: 5–7 minutes On July 23, 2025, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) published three general licenses related to the Venezuela Sanctions Regulations. The licenses are General License 41A, 5R, and 41B. Details of New Licenses General License No. 41A GL 41A was issued on March 4, 2025. This license allowed people to wind down certain transactions connected to Chevron Corporation’s joint ventures in Venezuela. These actions had to be finished before April 3, 2025. The license allowed only necessary actions related to closing out operations. This involved Chevron and its subsidiaries, along with partners like Petróleos de Venezuela, S.A. (PdVSA) and companies owned more than 50 percent by PdVSA. GL 41A did not allow: Payment of any taxes or royalties to the Government of Venezuela. Payment of any dividends, including in-kind dividends, to PdVSA or its owned companies. Selling oil or oil products from the Chevron joint ventures to places outside the United States. Any deal with a Venezuelan company owned or controlled by a Russian company. Any activity otherwise banned by the Venezuela Sanctions Regulations, unless separately allowed. GL 41A replaced General License No. 41. General License No. 5R GL 5R was issued on March 6, 2025. This license will allow, starting July 3, 2025, all transactions related to the Petróleos de Venezuela 2020 8.5 Percent Bond. This includes financing, handling, and other dealings that would otherwise be banned by Executive Orders 13835 and 13857, and the Venezuela Sanctions Regulations. GL 5R does not permit activities otherwise disallowed by the sanctions rules in 31 CFR chapter V. It replaced General License No. 5Q. General License No. 41B GL 41B was issued on March 24, 2025, and replaced GL 41A. This license authorizes the wind down of certain transactions tied to Chevron’s Venezuela joint ventures until May 27, 2025. Like GL 41A, it allows only actions needed to close out business with Chevron joint ventures, PdVSA, and PdVSA-owned firms. GL 41B does not allow: Payment of taxes or royalties to the Venezuelan government. Payment of any dividends, including in-kind, to PdVSA or its companies. Sale of oil or oil products from these joint ventures to countries other than the United States. Deals with Venezuelan companies owned or controlled by Russian companies. Any action banned by the Venezuela Sanctions Regulations, unless specifically allowed. GL 41B also states: People must still follow rules from other federal agencies, such as the Department of Commerce’s Bureau of Industry and Security. The license does not allow Chevron joint ventures to start working in new oil fields in Venezuela. All these licenses were made available on OFAC’s website when issued. The Acting Director of OFAC, Lisa M. Palluconi, signed each license. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

OFAC Briefing 2025-07-23

Treasury Department, Foreign Assets Control Office Briefing 2025-07-23 Estimated reading time: 5 minutes 1. Publication of Venezuela Sanctions Regulations Web General Licenses 41A, 5R, and 41B Sub: Treasury Department, Foreign Assets Control Office Content: The Department of the Treasury’s Office of Foreign Assets Control (OFAC) is publishing three general licenses (GLs) issued pursuant to the Venezuela Sanctions Regulations: GLs 41A, 5R, and 41B, each of which was previously made available on OFAC’s website. 2. Publication of Russian Harmful Foreign Activities Sanctions Regulations Web General License 13M Sub: Treasury Department, Foreign Assets Control Office Content: The Department of the Treasury’s Office of Foreign Assets Control (OFAC) is publishing a general license (GL) issued pursuant to the Russian Harmful Foreign Activities Sanctions Regulations: GL 13M, which was previously made available on OFAC’s website. 3. Publication of Russian Harmful Foreign Activities Sanctions Regulations Web General License 13N Sub: Treasury Department, Foreign Assets Control Office Content: The Department of the Treasury’s Office of Foreign Assets Control (OFAC) is publishing a general license (GL) issued pursuant to the Russian Harmful Foreign Activities Sanctions Regulations: GL 13N, which was previously made available on OFAC’s website. 4. Publication of Russian Harmful Foreign Activities Sanctions Regulations Web General Licenses 55D and 115B Sub: Treasury Department, Foreign Assets Control Office Content: The Department of the Treasury’s Office of Foreign Assets Control (OFAC) is publishing two general licenses (GLs) issued pursuant to the Russian Harmful Foreign Activities Sanctions Regulations: GLs 55D and 115B, each of which was previously made available on OFAC’s website. 5. Publication of Global Terrorism Sanctions Regulations Web General License 33 Sub: Treasury Department, Foreign Assets Control Office Content: The Department of the Treasury’s Office of Foreign Assets Control (OFAC) is publishing a general license (GL) issued pursuant to the Global Terrorism Sanctions Regulations: GL 33, which was previously made available on OFAC’s website. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Agency Information Collection Activities; Proposed Collection eComments Requested; Revision and Extension of a Previously Approved Collection; Notice of Appeal From a Decision of an Immigration Judge (Form EOIR-26); Correction

Justice Department Corrects Notice on Immigration Appeal Form Fees After Recent Law Change Estimated reading time: 3–5 minutes The Department of Justice (DOJ) has released a correction regarding the collection of information for the Notice of Appeal From a Decision of an Immigration Judge, Form EOIR-26. The correction was published in the Federal Register on July 23, 2025, by the Executive Office for Immigration Review (EOIR). The update relates to an earlier notice that appeared in the Federal Register on July 1, 2025. This correction adds one more change to the information collection process. EOIR will submit the updated collection request to the Office of Management and Budget (OMB) for approval. This follows rules found in the Paperwork Reduction Act of 1995. The comment period for this proposed change is still open until September 2, 2025. Anyone needing more information or wishing to comment on the public burden, response time, or methods related to this collection, can contact Justine Fuga, Associate General Counsel, at the EOIR. Contact details are: Address: 5107 Leesburg Pike, Suite 2600, Falls Church, VA 22041 Telephone: (703) 305-0265 Email: [Contact information provided in the original source] The correction makes the instructions for how to file Form EOIR-26, both by mail and electronically, more clear. It also updates information about new filing fees. These fee changes are the result of the One Big Beautiful Bill Act (OBBBA), H.R. 1, which became law on July 4, 2025. The corrected estimated annual cost is $12,747,978 for the public. According to EOIR estimates: 12,487 responses each year come from applicants who have to pay a filing fee. 647 responses come from Department of Homeland Security Immigration and Customs Enforcement (DHS ICE) employees, who are not required to pay a filing fee. The cost per response is as follows: For regular applicants: $0.80 for printing, $10.10 for postage, and $1,010 for the filing fee. The total per response is $1,020.90. For DHS ICE: $0.80 for printing, $10.10 for postage, and no filing fee. The total per response is $10.90. Total annual costs are calculated as follows: $1,020.90 multiplied by 12,487 responses equals $12,747,978 for applicants required to pay. $10.90 multiplied by 647 responses equals $7,052 for DHS ICE. The correction is signed by Darwin Arceo, Department Clearance Officer for PRA, DOJ. This update ensures the information collection aligns with the new law and provides clarity on costs and filing instructions. The public and interested parties may continue to submit comments until September 2, 2025. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

DOJ Briefing 2025-07-23

Justice Department Briefing 2025-07-23 Estimated reading time: 5 minutes 1. Agency Information Collection Activities; Proposed eCollection eComments Requested; Appeals of Background Checks Sub: Justice Department Content: The Department of Justice (DOJ), Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF), will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. 2. Agency Information Collection Activities; Proposed eCollection eComments Requested; Voluntary Magazine Questionnaire for Agencies/Entities That Store Explosive Materials Sub: Justice Department Content: The Department of Justice (DOJ), Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF), will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. 3. Agency Information Collection Activities; Proposed eCollection eComments Requested; Furnishing of Explosives Samples Sub: Justice Department Content: The Department of Justice (DOJ), Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF), will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. 4. Agency Information Collection Activities; Proposed eCollection eComments Requested; Title Records of Acquisition and Disposition: Dealers/Pawnbrokers of Type 01/02 Firearms, and Collectors of Type 03 Firearms Sub: Justice Department Content: The Department of Justice (DOJ), Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF), will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. 5. Agency Information Collection Activities; Proposed Collection eComments Requested; Revision and Extension of a Previously Approved Collection; Notice of Appeal From a Decision of an Immigration Judge (Form EOIR-26); Correction Sub: Justice Department Content: The Executive Office for Immigration Review (EOIR) at the Department of Justice (DOJ) published a document in the Federal Register on July 1, 2025, at 90 FR 28815, requesting comments and suggestions from the public and affected agencies concerning a proposed collection of information. This document proposes one additional change to the information collection instrument, and EOIR will be submitting the following information collection request to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

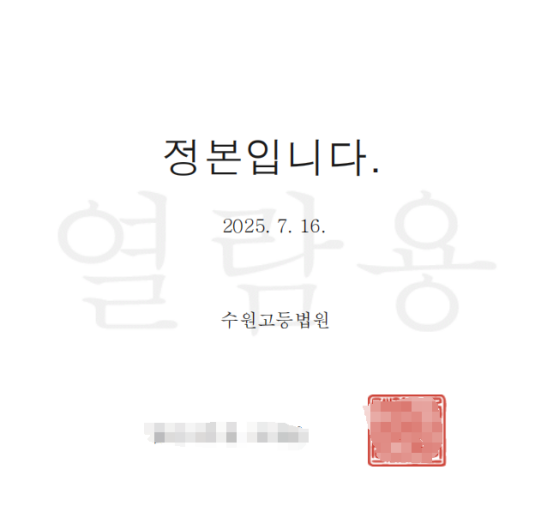

Cross-Border Litigation: 2nd Instance Victory in South Korea

Fan Zhang, Director at JINGSH Chengdu, led her team to secure a court victory in a major international trade dispute case involving a Hong Kong company and a Korean company before the Suwon District Court Seongnam Branch.

Application for Relief From Disabilities Imposed by Federal Laws With Respect to the Acquisition, Receipt, Transfer, Shipment, Transportation, or Possession of Firearms

Department of Justice Proposes New Rules on Federal Firearm Rights Restoration Estimated reading time: 8–10 minutes On July 22, 2025, the Department of Justice published a proposed rule in the Federal Register. The rule sets out how people can apply for relief from federal laws that stop them from having guns. Why the Rule Is Needed The Gun Control Act makes it illegal for some people to have firearms. This includes people with certain criminal records, people with mental health commitments, and others considered dangerous. But the Act also gives people a way to ask for their rights back. This is called “relief from disabilities.” Before 2025, the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) handled these requests. Problems appeared. There were not enough rules for deciding who should get their rights back. Some dangerous people got their rights restored, and later, committed crimes. Because of this, Congress stopped ATF from using funds to process these applications in 1992. Recently, the Attorney General took authority away from ATF and announced a new rule would be made. About the Proposed Rule The new rule sets out clear criteria for granting relief. It tries to keep dangerous people from getting guns, while respecting the Second Amendment. Presumptive Disqualifications Convictions for violent or dangerous felonies like murder, sexual assault, kidnapping, domestic violence, burglary, robbery, arson, and more. Felony sex offenses. People required to register as sex offenders. Anyone convicted of a felony using guns or explosives. Anyone convicted in the past 10 years of drug distribution crimes. Anyone convicted in the past 10 years for a misdemeanor crime of domestic violence, or shown to still be violent. Anyone convicted in the past 5 years for other felony offenses. People currently in prison or on probation, parole, or supervision. People subject to certain other gun disqualifications (like being a fugitive, using illegal drugs, being under restraining orders, or being in the country illegally). Anyone denied under these rules in the past. Looking at the Whole Story The Attorney General can look at all the facts of a person’s case—not just the official name of the crime. This means the actual conduct, not just the law’s wording, is used to decide eligibility. The rule says applications will also require input from local law enforcement. What Applicants Must Do Applicants must give: Detailed records about past convictions. Proof that criminal sentences are completed. Reference letters from people not related to them. Personal affirmations about their behavior and character. Notification to the chief law enforcement officer in their area. Applicants must show they are not dangerous and that restoring their rights is in the public interest. Fees The Department estimates about 1 million people will apply in the first year. Applicants must pay a $20 fee (unless poor, then a waiver may be requested). This covers costs for handling the applications. Reviewing Applications The Attorney General will review each applicant’s full criminal record, behavior during supervision, time since release, current mental health, community reputation, drug or alcohol use, and more. Input from police chiefs or sheriffs will be considered. Any false information in the application can cause removal of granted rights. Other Points The relief applies only to federal gun laws. State gun bans are not changed by this rule. The rule applies to people and gun dealers. Changes are made to access federal gun background system records. If rights are restored but the person commits a new crime, the relief can be taken back. How to Comment Comments on the rule are due by October 20, 2025. People can use regulations.gov or mail a comment to the U.S. Department of Justice. Impact The Department says the rule will help protect public safety, make the process clearer, and allow fair restoration of rights. It says the new system will be fair and follow the law. For more details, see the Federal Register, Volume 90, Number 138, pages 34394–34405, dated July 22, 2025. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

DOJ Briefing 2025-07-22

Justice Department Briefing 2025-07-22 Estimated reading time: 3 minutes 1. Application for Relief From Disabilities Imposed by Federal Laws With Respect to the Acquisition, Receipt, Transfer, Shipment, Transportation, or Possession of Firearms Sub: Justice Department Content: The Department of Justice (“the Department”) proposes to implement criteria to guide determinations for granting relief from disabilities imposed by Federal laws with respect to the acquisition, receipt, transfer, shipment, transportation, or possession of firearms. In accordance with certain firearms laws and the Second Amendment of the Constitution, the criteria are designed to ensure the fundamental right of the people to keep and bear arms is not unduly infringed, that those granted relief are not likely to act in a manner dangerous to public safety, and that granting such relief would not be contrary to the public interest. 2. Thomas Draschil, M.D.; Decision and Order Sub: Justice Department, Drug Enforcement Administration Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Active Anode Material From the People’s Republic of China: Preliminary Affirmative Determination of Sales at Less Than Fair Value, Postponement of Final Determination and Extension of Provisional Measures

U.S. Finds Chinese Active Anode Material Sold Below Fair Value Estimated reading time: 3–5 minutes U.S. Finds Chinese Active Anode Material Sold Below Fair Value The U.S. Department of Commerce says that active anode material from the People’s Republic of China is likely being sold in the United States for less than fair value. This is a preliminary decision. The period being investigated is from April 1, 2024, through September 30, 2024. The Department is asking for comments on their decision. Why This Matters Active anode material is used in making batteries. It is a kind of graphite with a high purity of carbon — at least 90%. This investigation looks at the graphite whether it is coated or not. The product must also have a high energy density and be mostly made out of graphite crystals. Scope of Investigation The investigation covers active anode material from China. This includes materials that are powders, blocks, or liquids, and it covers the materials whether or not they have other things mixed in, like silicon. The product is included even if it is made as part of a battery or as part of a mixture. Most of these materials are categorized under the U.S. Harmonized Tariff Schedule codes 2504.10.5000 and 3801.10.5000. Other codes may also include these products. How the Investigation Worked The Department of Commerce looked at sales information from China. They used special rules because China is considered a non-market economy. Most companies did not show that they are run independently from the Chinese government. So, the Department treated those companies as part of the “China-wide entity.” A very high dumping margin was assigned to this group. Dumping Margins A dumping margin means how much cheaper the product is sold in the U.S. compared to its normal value. The Department found rates of 93.50% for most producer and exporter pairs who could prove they operated independently. For companies that could not prove this, the dumping margin is even higher: 102.72%. These rates mean the products are being sold for much less than their real value. List of Companies Affected Many companies are listed. Some examples: Carbon ONE New Energy Group Co., Ltd. Canadian Solar Energy Holding Company Limited Farasis Energy (Zhenjiang) Co., Ltd. Tesla Manufacturing Brandenburg SE Tesla (Shanghai) Co., Ltd. LG Energy Solution (Nanjing) Co. Ltd. Panasonic Energy Nandan, Co., Ltd. Samsung SDI Energy Malaysia Sdn, Bhd. Hunan Zhongke Shinzoom Co., Ltd. All these combinations are assigned a 93.50% margin. The “China-wide entity” gets a margin of 102.72%. What Happens Next U.S. Customs will stop releasing these products for regular sale. Importers will have to pay cash deposits based on the margins above. If the companies cannot prove they operate separately from the Chinese government, they will have to pay the highest margin. These rules will last until the Department of Commerce makes a final decision. The Department plans to finish the investigation by November 2025. After that, the International Trade Commission will also check if these imports hurt U.S. companies. How to Respond People or companies affected can comment on this decision within 30 days. They can also ask for a hearing about this investigation. More Information This news follows the procedures in the Tariff Act of 1930 and other U.S. trade laws. The Department of Commerce will review all comments and issue a final decision. If there was a mistake in the decisions, the Department will make corrections. Key Terms Active anode material: Graphite used in batteries, high in carbon, with high energy storage. Dumping margin: How much the import price is below its normal value. Provisional Measures: Temporary rules to collect cash deposits on imports until a final decision is made. This decision was posted by Christopher Abbott, Deputy Assistant Secretary for Policy and Negotiations, on July 16, 2025. The official Federal Register entry can be found at the U.S. Government website. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Hardwood and Decorative Plywood From the People’s Republic of China, Indonesia, and the Socialist Republic of Vietnam: Postponement of Preliminary Determinations in the Countervailing Duty Investigations

U.S. Delays Key Step in Plywood Import Trade Investigation Estimated reading time: 1–7 minutes The U.S. Department of Commerce announced a delay in the preliminary findings of its countervailing duty investigations into hardwood and decorative plywood from China, Indonesia, and Vietnam. This update was published in the Federal Register on July 22, 2025. The investigations started on June 11, 2025. They focus on whether imports of these types of plywood from the three countries receive unfair government support, which can affect fair trade in the U.S. The original due date for the preliminary determination was August 15, 2025. However, the deadline can be extended to give the Department more time. According to U.S. law, Commerce can delay this step if the investigation is complex or if there is a request from the petitioner. On July 7, 2025, the Coalition for Fair Trade in Hardwood Plywood, the main group behind the complaint, formally asked Commerce to postpone the deadline. Their reason was to allow more time to fully review answers from mandatory respondents and to send out more questions if needed. The request was made at least 25 days before the original deadline. U.S. rules were followed, and Commerce did not find any reason to deny the request. Because of this, the Department of Commerce is postponing the preliminary determination. The new deadline is now October 20, 2025. This is because the 130th day after June 11 falls on a Sunday, so the decision moves to the next business day, which is Monday, October 20. The final determination in these investigations will still be due 75 days after the new preliminary determination date. For more details, the contact persons at the Department of Commerce are Rebecca Janz (China), Samuel Evans (Indonesia), and Sofia Pedrelli (Vietnam). The notice was signed by Christopher Abbott, Deputy Assistant Secretary for Policy and Negotiations. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Circular Welded Carbon Quality Steel Pipe From the People’s Republic of China: Preliminary Affirmative Determination of Circumvention of the Antidumping Duty and Countervailing Duty Orders

U.S. Finds China-Origin Steel Pipes Shipped from Oman Circumvent Trade Orders Estimated reading time: 6–10 minutes The U.S. Department of Commerce has announced a preliminary decision in an important trade case. Imports of circular welded carbon quality steel pipes (CWP) made in the Sultanate of Oman, using hot-rolled steel (HRS) from the People’s Republic of China, are found to be avoiding U.S. antidumping duty (AD) and countervailing duty (CVD) orders on steel pipe from China. This is called “circumventing the Orders.” Background of the Case Commerce put AD and CVD orders on CWP from China in July 2008. On November 19, 2024, Commerce began investigating whether CWP shipped from Oman to the U.S., but made with steel from China, was actually covered by the existing trade Orders. Al Jazeera Steel Products Company SAOG in Oman was chosen as the main respondent for this investigation. The deadline for the preliminary decision was extended to July 17, 2025. Products Covered The products discussed are circular welded carbon quality steel pipes and tubes, which are widely used in building and industry. Pipes completed in Oman, using steel produced in China, and then sent to the U.S., are the subject of this investigation. How the Determination was Made Commerce used Section 781(b) of the Tariff Act of 1930 and other rules for its investigation. Preliminary Decision Commerce has preliminarily decided that CWP made in Oman using Chinese-origin HRS, and then sent to the U.S., is circumventing U.S. AD and CVD Orders. This means these pipe imports will now be treated as if they came from China when it comes to trade rules. Suspension of Liquidation and Cash Deposits Because of this decision, Customs and Border Protection (CBP) will now “suspend liquidation” of these products. This means they will not finish processing these imports for duty payments right away. Companies must also pay cash deposits as security for estimated trade duties for shipments that came in on or after November 19, 2024. If the CWP is made in Oman with non-Chinese HRS, it is not covered by this decision. If the certifications (explained below) are met, no cash deposit or suspension is required. If certifications are missing or wrong, CBP will take action. AD cash deposits may be set at up to 85.55 percent and CVD cash deposits at 39.01 percent. Special case numbers have been created in the Automated Commercial Environment (ACE) for this trade issue. Certification Requirements To follow the new rules, importers and exporters must complete special certifications for each shipment. These documents prove that the pipes do not use Chinese HRS, or that another input was used. Importers must upload their certification, the exporter’s certification, invoices, and shipping paperwork into CBP’s document system at the time of entry summary. Exporters also fill out and keep their certification. They must give the importer a copy. Claims in the certifications, and any supporting documents, can be checked by Commerce or CBP. All records must be kept for at least five years, or three years after any court case about the entries finishes. For shipments between November 19, 2024, and August 13, 2025, where entries are not yet final, certifications must be finished and uploaded no later than September 8, 2025. Blanket certifications covering several shipments are allowed. Shipments declared without recognizing the AD or CVD case numbers must have their status corrected with CBP and pay any owed duties. Comments and Hearings Interested parties have seven days after the last verification report to submit case briefs. They may also submit rebuttal briefs five days later. Briefs should include a summary and a table of authorities. Hearing requests must be filed within 30 days of the notice. If held, the hearing will only discuss issues listed in the briefs. International Trade Commission Notification Commerce will notify the U.S. International Trade Commission (ITC) about this decision. The ITC can ask questions or request a meeting within 60 days. If the ITC finds that including these imports would be a significant injury issue, it can provide written advice. Certifications Details There are official forms for both importers and exporters. The certifications require detailed information about the shipment, the steel’s origin, and a sworn statement that no Chinese HRS was used if claiming an exemption. Both must keep all documents, and it is a crime to make false statements. What’s Next This is a preliminary decision. Commerce may verify the information before making a final decision. The rules will stay in effect until Commerce announces otherwise. Official Contact For more information, the notice was prepared by Shawn Gregor, Office of Policy, Enforcement and Compliance, International Trade Administration, U.S. Department of Commerce. Legal Disclaimer This article includes content collected from the Federal Register (federalregister.gov). The content is not an official government publication. This article is for informational purposes only and does not constitute legal advice. For case-specific consultation, please contact us. Read our full Legal Disclaimer, which also includes information on translation accuracy.

Certain Steel Threaded Rod From the People’s Republic of China: Continuation of Antidumping Duty Order